Origin of the Name:

The name Philippines was named after the Spanish King Philip II who ruled during the country’s colonization by Spain in the 16th century, by the Spanish explorer Ruy Lopez de Villalobos during his 1542-1546 expedition to the islands.

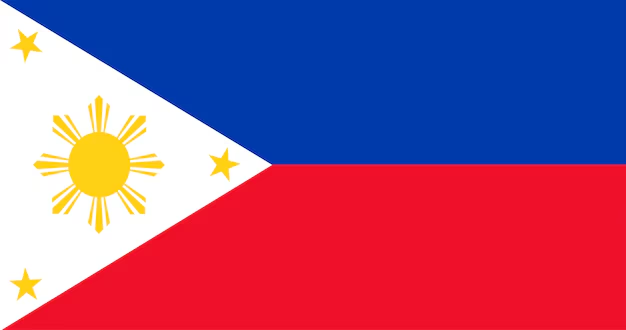

Philippine Flag:

The Philippine flag consists of horizontal stripes of blue and red with a white hoist triangle incorporating a golden sun and three stars. The three stars on the Philippine flag symbolise the country’s three principal island groups: Luzon, Visayas, and Mindanao. For over 300 years, Filipinos toiled under an oppressive Spanish regime—and so when our flag was first raised to declare independence on June 12, 1898, in Kawit, Cavite, it became a symbol of strength and pride.

Capital City: Manila is the capital city of the Philippines.

History & Independence:

Pre-colonial: The Philippines was home to various indigenous tribes and kingdoms before the arrival of Spanish colonizers in the 16th century.

Colonial: The country was under Spanish rule for over 300 years before being ceded to the United States in 1898. The Philippines gained independence from the U.S. in 1946 after World War II.

Independence: The Philippines celebrates its Independence Day on June 12, commemorating its declaration of independence from Spain in 1898.

Experience seamless business trips with Travel Business Assistance – Schedule your complimentary consultation call today!

Government:

A republic with a presidential form of government wherein power is equally divided among its three branches: executive, legislative, judicial

Language:

Filipino (based on Tagalog) and English are official languages of the Philippines. Filipino is the national language. Filipinos speak English as a second language.

Business Culture:

Business in the Philippines is often conducted formally, with a mix of Western and Asian business practices.

Population:

The 2020 Census of Population and Housing puts the total population of the Philippines at 109,035,343.

Demographics:

Spanish, and American influences.

Economy:

The Philippines has a diverse population with various ethnic groups, primarily Malay, Chinese, From 2011 to 2019, the Philippines GDP experienced a compound annual growth rate (CAGR) of 5.5%, supported by an economic policy framework that focused on improving transparency and accountability in governance, strengthening the macroeconomy, boosting the competitiveness of industries, developing infrastructure and strengthening the financial sector and capital mobilization. In 2023, the country posted a GDP growth rate of 5.6%. The Philippine Government has set a target GDP growth range of 6.5% to 8.0% until 2028 as outlined in the Philippine Development Plan 2023-2028. Consistent with the economic growth, the country’s GNI has also experienced improvements post-pandemic, with an average rate of 2.65%. In terms of industrial sectors, Services has been the biggest contributor of GNI.

Time Zone:

The Philippines Standard Time (PST) is 8 hours ahead of Coordinated Universal Time (UTC+8).

Climate:

The climate of the Philippines is divided into two seasons based on temperature and rainfall: the rainy season from June to November, and the dry season from December to May. It is characterized by relatively high temperature, high humidity and abundant rainfall.

Borders:

The Philippine archipelago is bounded by the Philippine sea to the east, the Celebes sea to the south, the Sulu sea to the southwest, and the South China sea to the west and north. The Philippines has maritime borders with China, Japan, Vietnam, Malaysia, Taiwan, Indonesia, and Palau

Size:

The Philippines consists of over 7,100 islands but in 2016 the National Mapping and Resource Information Authority of the Philippines announced the discovery of more than 500 previously uncharted islands. The archipelago stretches about 1,150 miles (1,850 km) from north to south, and its widest east-west extent, at its southern base, is some 700 miles (1,130 km).

Religion:

The Philippines is predominantly Roman Catholic (78.8%), with a significant Muslim minority and other religious groups.

Currency & Exchange Rate:

The currency of the Philippines is the Philippine Peso (PHP). The exchange rate varies but is around 1 USD to 58 PHP.

Practical Tips:

When using the Philippine Peso, have small denominations for easier transactions. Be cautious of counterfeit money and use reputable exchange services.

Philippine Food:

Iconic Dishes: Adobo, Sinigang, Lechon, Halo-Halo. Beyond the Classics: Kare-Kare, Balut, Sisig, Bicol Express

Things to Do and See:

Cultural and Historical Sites: Intramuros in Manila, Fort Santiago, Banaue Rice Terraces, Vigan City, Rizal Park, Magellan’s Cross

Relaxation and Leisure: Boracay, Palawan, Siargao. Cebu

Festivals and Events: Sinulog Festival, Ati-Atihan Festival, Pahiyas Festival.

Living and Investing in the Philippines:

Living: Cost of living is relatively low in the Philippines compared to Western countries. Expatriates can enjoy a comfortable lifestyle with affordable housing, healthcare, and a variety of leisure activities.

Political Overview:

President serves as both the head of state and the head of government.

Legal System:

Provided by Exceed Executive Concierge

- Sources of Law:

The Philippines is a unitary presidential constitutional republic with a multi-party system. The The legal system of the Philippines is based on a combination of civil law and common law traditions. The country’s legal framework is influenced by Spanish, American, and indigenous laws. Three separate and independent branches: the Executive, the Legislative, and the Judicial.

The Philippines adopted a civil law system established by laws passed by the legislature, with the 1987 Constitution as the fundamental law of the land. Secondary authoritative sources of law are the decisions issued by the Supreme Court, implementing rules and regulations issued by regulatory authorities (such as the Securities & Exchange Commission [SEC], Department of Trade and Industry [DTI], and Philippine Competition Commission [PCC], among others), and the executive orders issued by the Office of the President

- Court System:

The Philippine court system is composed of the Supreme Court, lower courts, and special courts.

The Supreme Court is the highest judicial body in the country.

Investments:

The Philippines offers investment opportunities in various sectors such as real estate, tourism, business process outsourcing, and manufacturing. Foreign investors are encouraged to explore the country’s Special Economic Zones for tax incentives and other benefits.

Doing Business in the Philippines:

Registration with the SEC or the DTI is required before an entity can do business in the

Philippines. While the Revised Corporation Code does not define the term “doing business”, Republic Act No. 7042, as amended, otherwise known as the Foreign Investments Act of 1991 (FIA) enumerates certain activities that are deemed to constitute “doing business” in the Philippines

The FIA is the primary governing law on foreign investments in the Philippines. The FIA was further amended in 2022 to liberalize restrictions on foreign investments in recognition of the benefits of the increased capital and introduction of new technology, and the effects of global and regional economies in the Philippine economy. The Philippines adopted a policy to attract, promote, and welcome foreign investments as a supplement to Filipino capital and technology.

As a rule, there are no restrictions on foreign investments, except in restricted activities as provided in the Constitution and applicable laws. These restricted activities are outlined in the Foreign Investments Negative List promulgated and updated by the Office of the President. Eight (8) main types of business vehicles may be registered in the Philippines. The business vehicles may be categorized as domestic or foreign:

- Domestic Entities. Subject to the restrictions on foreign direct investments, foreign nationals may organize and register the following business types under and in accordance with Philippine laws:

- Sole Proprietorship: which is owned by, and registered in favor of, only one (1) individual who must register with DTI. A sole proprietorship does not possess a juridical personality separate and distinct from the personality of the owner of the business.

- Partnership: a partnership has its legal personality separate and distinct from that of its partners. A partnership may either be a (1) general partnership, where the partners have unlimited liability for the debts and obligation of the partnership, or (2) limited partnership, where one or more general partners have unlimited liability and the limited partners have liability only up to the amount of their capital contributions.

- One Person Corporation (OPC): The OPC consists of a single stockholder who is also the sole director and president. The single stockholder may likewise be appointed as the treasurer, provided that he submits a bond, renewable every two (2) years to the Securities and Exchange Commission (SEC). The OPC has a separate legal identity from the single stockholder, which allows the businessman to limit his liability in the conduct of his business, and to gain complete control and authority to manage his business affairs without the need to seek consensus and approval from a board of directors or stockholders. capital requirement.

- Corporation: A corporation has a legal personality separate and distinct from that of its stockholders. The Philippines recently revised its Corporation Code to ease the requirements to incorporate. Among others, the Revised Corporation Code now (i) allows corporate entities as incorporators, (ii) reduces the number of incorporators to at least two (2) from the previous minimum requirement of five (5) individual incorporators, (iii) allows perpetual corporate term, and (iv) removed the minimum subscribed and paid-up Foreign Corporations. Foreign corporations may likewise seek to register with the SEC and obtain a license to transact as a:

- Branch office: As an extension of a foreign corporation, the branch office carries out the business activities of the foreign head office. It has no separate legal personality from the foreign head office. Consequently, any liability incurred by the branch is a liability of the head office.

- Representative Office: A foreign corporation may likewise establish a representative office in the Philippines to perform limited activities, such as information dissemination, act as a communication center and promote company products, as well as quality control of products for export. The representative office may not derive any income from the Philippines.

- Taxation: Headquarters: The foreign corporation may also establish either a Regional or Area Headquarters (RHQ) or Regional Operating Headquarters (ROHQ) in the Philippines:

- RHQ: An RHQ acts as an administrative branch of a foreign company, and shall principally serve as a supervision, communications and coordination centre for the foreign company’s subsidiaries, branches or affiliates in the Asia-Pacific Region and other foreign markets. As an administrative branch, the RHQ may not earn or derive income in the Philippines.

- ROHQ: The ROHQ is allowed to derive income in the Philippines. However, it only performs qualifying services to its affiliates, subsidiaries or branches in the Philippines, in the Asia-Pacific Region and other foreign markets, particularly in General administration and planning; Business Business development. planning and coordination; Sourcing/procurement of raw materials and components; Corporate finance advisory services; Marketing control and sales promotion; Training and personnel management; Logistics services;

Research and development services, and product development; Technical support and maintenance; Data processing and communication; and Other developments and opportunities for investors: Fintech Industry, real estate industry, healthcare industry, energy industry, defence and security industry.

The Philippine government imposes two types of taxes: national and local tax. National taxes or internal revenue taxes are governed by Republic Act No. 8424, otherwise known as the “National Internal Revenue Code of 1997”, and its amendments (Tax Code). The Bureau of Internal

Revenue (BIR), the country’s taxing authority, issues circulars to clarify and interpret the Tax Code, and rules and regulations prescribing the guidelines for its implementation. On the other hand, local taxes are levied and collected by Local Government Units (LGUs), such as provinces, cities, municipalities, and barangays. The local taxes are imposed by ordinances issued by the relevant Sanggunian of the LGUs. A taxpayer identification number (TIN). The BIR likewise requires registration of an enterprise’s books of account, sales invoices, and official receipts.

Income Tax: A citizen and a domestic corporation are taxable on all income derived from sources within and outside the Philippines. On the other hand, non-resident citizens, and foreign individuals and corporations, whether or not engaged in trade or business in the Philippines through a branch office, are taxable only for all income sourced within the Philippines. The income tax rate in the Philippines depends on the tax status of the income recipient. Citizens and resident foreign individuals (Non resident aliens engaged in trade or business within the Philippines are generally subject to the same tax rate) are tax at a graduated tax rate of 0% (for annual income not exceeding P250,000) to 35% of taxable income. Non-resident foreign individuals not engaged in trade or business in the Philippines are tax at 25% of gross income.

Domestic corporations and resident foreign corporations are tax at 25% on taxable income. However, for domestic corporations with net taxable income not exceeding Five Million pesos (P5,000,000) and total assets not exceeding One Hundred Million (P100,000,000), excluding the land on which the particular business entity’s office, plant and equipment are situated, twenty percent (20%) income tax rate will apply. Non-resident foreign corporations are tax at 25% of gross income. Profits of a Philippine branch, which are remitted to the head office are generally subject to the branch profit remittance tax at the rate of fifteen percent (15%) of the total profits applied or earmarked for remittance without any deduction for the tax component thereof. The fifteen percent (15%) tax will be withheld by the branch and paid to the BIR.

Withholding tax: Registered taxpayers may be appointed as withholding tax agents for income received by certain payees. This includes withholding tax on compensation received by employees. The rate depends on the taxable income of each employee which could go up to thirty-five percent (35%) maximum rate. Other withholding taxes may be applicable depending on the nature of the transaction and the payee. Withholding tax rates vary from one percent (1%) to fifteen percent (15%) of the payment. The withholding agent’s remittance of the withholding tax to the BIR is required before the related expense may be claimed as allowable deductions for purposes of computing the income tax.

Dividends tax: Dividends received by a domestic corporation or resident foreign corporation from a domestic corporation are exempt from tax. However, those received by a nonresident foreign corporation from a domestic shall be subject to a final withholding tax either 10% or 15%.

Capital Gains Tax (CGT) : Imposed on transfer of shares not traded I the stock exchange at the rate of 15%of the net capital gains realized during the taxable year, maybe exempt under applicable tax treaty and/or under certain conditions.

Documentary Stamp Tax (DST) :Is due upon documents, instruments, loan agreements and papers that is incidental to acceptances, assignments, sales and transfers of obligations, right or property.

Value Added Tax (VAT): VAT is generally imposed on the sale of goods and services, barter or exchange of goods or properties, as well as importation in the Philippines. Generally, VAT is at twelve percent (12%) of the gross selling price or gross value in money of the goods or properties sold, or the gross receipts derived from the sale of services, including the lease of properties.

For imported goods, VAT is imposed on the total value used by the Bureau of Customs (BOC) in determining tariff and customs duties, plus customs duties, excise taxes, if any, and other charges, provided that where the customs duties are determined based on the quantity or volume of the goods, VAT is based on the landed cost plus excise taxes, if any. A VAT taxpayer may use the VAT on its purchases (Input VAT) as a credit against its VAT on the sale of its goods and services (Output VAT). However, if the taxpayer’s gross annual sales and/or receipts from sales or lease of goods or properties, or the performance of service do not exceed P3,000,000.00 in a taxable year, such taxpayer may opt to register as a non-VAT taxpayer, and be subject to percentage tax of three percent (3%) of its gross sales and/or receipts, instead of VAT. Certain transactions are subject to zero percent (0%) VAT, in which case, the taxpayer is entitled to a refund of unused Input VAT paid on purchases related to the zero-rated transaction. Sales may also be exempt from VAT.

Local Tax: Local Government Units (LGU) in the Philippines are likewise granted authority to levy taxes as their own source of revenue, subject to certain limitations. The local taxes are distinct and separate from the national taxes collected by the BIR. Among others, LGUs impose business tax and real property tax within their jurisdictions. Under the Local Government Code (LGC), municipalities and cities may impose business tax on persons engaged in trade or commercial activity regularly as a means of livelihood or to profit. The type of business subject to local business tax and the rate thereof shall depend upon the local tax ordinance enacted by the concerned local Sanggunian.

Immigration:

The Philippines has various visa options for tourists, expatriates, investors, and retirees. Immigration laws and regulations are set by the Bureau of Immigration, under the Department of Justice.

- 9(d) Treaty Trader or Treaty Investor : This visa is available only if the foreigner is a national of a country with which the Philippines has in place an agreement for the admission of treaty traders or investors, specifically (1) the United States of America, (2) Japan, and (3) Germany.

- 9(g) Pre-arranged Employment Visa (Commercial Visa) : This is a working visa that allows employers/proprietors in the Philippines to employ foreign nationals with skills, qualifications, and experience that may be short in supply in the Philippines. working visa under the oversight of the Department of Justice. and investments are maintained

- Special Non-Immigrant Visa (47(a)(2) Visa) : The 47 (a) 2 visa is a special category of

- Special Investor’s Resident Visa (SIRV) under Executive Order 226 or the Omnibus Investment Code of 1987: The Special Investor’s Resident Visa (SIRV) entitles the holder to reside in the Philippines for an indefinite period as long as the required qualifications

- Special Resident Retiree’s Visa (SRRV) : The SRRV is for active/healthy principal retirees 50 years old and above; and must deposit of at least US$20,000.00 in any of the designated banks (non-convertible to long term lease investment or condominium purchase) of the Philippine Retirement Authority (“PRA”).

Special Visa for Employment Generation (“SVEG”) : This visa is founded on public interest, particularly on an aspect of employment generation for Filipinos - Special Investor’s Resident Visa under EO 63 or the Law Granting Incentives to Foreign Investment in Tourist-Related Projects and Tourist Establishments and for Other

Purposes: This visa is given as an incentive and part of the enhancement of international tourism through the acquisition or operation of tourist establishments and tourist related projects in our country and by the infusion of capital therein by foreign investors - Special Visas Issued by Economic Zones : Subic and Clark Special Economic Zone under Republic Act 7227 or the Bases Conversion and Development Act of 1992.

Education System:

The Philippines has a diverse education system with both public and private institutions. Education is compulsory up to the secondary level, and higher education is offered by universities and colleges. Formal education in the Philippines generally spans 16years: six years of primary school, four years of lower secondary education, two years of upper secondary education, and four years of tertiary education. The media of instruction in all levels are English and Filipino, as stated in the Philippine Bilingual Education Policy (BEP)

Healthcare System:

The healthcare system in the Philippines includes public and private healthcare facilities. Major cities have well-equipped hospitals, and the government provides healthcare services through the Philippine Health Insurance Corporation (PhilHealth). Healthcare services in the Philippines vary from basic clinics to advanced medical facilities in urban areas.

Transportation:

travel within the country.

Transportation in the Philippines includes a mix of modes such as jeepneys, buses, tricycles, taxis, and ride-sharing services. Major cities have airports, seaports, and a network of roads for The Philippines is rich in natural resources such as minerals, forests, marine resources, and geothermal energy. Sustainable management of these resources is crucial for economic development and environmental conservation.

Environmental Challenges:

The Philippines faces environmental challenges such as deforestation, pollution, natural disasters, and climate change impacts. Conservation efforts and sustainable practices are being implemented to address these issues.

Technology and Innovation:

The Philippines is emerging as a hub for technology and innovation, with a growing startup ecosystem and investments in information technology, business process outsourcing, and fintech sectors.

Cultural Heritage:

The Philippines has a rich cultural heritage influenced by indigenous, Spanish, American, and Asian traditions. Cultural sites, museums, festivals, and traditional arts showcase the country’s diverse heritage.

Cuisine and Culinary Traditions:

Filipino cuisine is a blend of flavors from various regions and cultures, featuring dishes with influences from Spanish, Chinese, and Malay cuisines. Street food, traditional dishes, and desserts are popular among locals and visitors.

Iconic Landmarks and Natural Wonders:

Tubbataha Reef attract tourists from around the world.

Sustainable Tourism:

The Philippines boasts stunning natural landscapes, including white sandy beaches, coral reefs, volcanoes, and rice terraces. Iconic landmarks such as Mayon Volcano, Chocolate Hills, and

The Philippines promotes sustainable tourism practices to preserve its natural beauty and cultural heritage. Responsible tourism initiatives focus on conservation, community engagement, and environmental protection. The Philippines is a vibrant and diverse country with a rich history, unique culture, and abundant natural resources. From its colonial past to modern-day innovations, the Philippines offers a mix of traditional charm and modern opportunities for visitors, investors, and residents alike. Exploring the beauty of the Philippines and engaging with its warm and hospitable people can be a truly enriching experience.

Arts and Literature:

Filipino arts and literature showcase a blend of indigenous, Spanish, and contemporary influences. Traditional dances, music, visual arts, and literary works reflect the country’s diverse cultural heritage.

Sports and Recreation:

Popular sports in the Philippines include basketball, boxing, volleyball, and martial arts. The country hosts various sports events, and outdoor activities like hiking, diving, and surfing are enjoyed by locals and tourists.

Music and Entertainment:

Filipino music covers a wide range of genres, including traditional folk music, pop, rock, and OPM (Original Pilipino Music). The country has a vibrant entertainment industry with talented musicians, singers, and actors.

Media and Communication:

The Philippines has a dynamic media landscape with newspapers, television networks, radio stations, and online platforms. Freedom of the press is upheld, and social media plays a significant role in communication and information sharing.

Social Issues:

these issues and improving the quality of life for all citizens.

Disaster Preparedness:

The Philippines faces social challenges such as poverty, inequality, corruption, and human rights issues. Various government and non-governmental organizations work towards addressing

Given its location along the Pacific Ring of Fire and exposure to typhoons, earthquakes, and volcanic eruptions, the Philippines prioritizes disaster preparedness and response efforts to mitigate the impact of natural disasters.

Philanthropy and Community Engagement:

Filipinos are known for their strong sense of community and bayanihan spirit, which involves collective action for the common good. Philanthropic initiatives, volunteer work, and community projects play a vital role in supporting those in need.

International Relations:

The Philippines maintains diplomatic relations with various countries and international organizations. As a member of ASEAN and other global bodies, the country engages in regional cooperation, trade agreements, and peace-building efforts.

Tourism and Hospitality:

The Philippines is a popular tourist destination known for its beautiful beaches, cultural attractions, and warm hospitality. The tourism industry contributes significantly to the country’s economy and provides employment opportunities. Based on Philippine Statistics Authority data, the contribution of tourism to the country’s gross domestic product grew from 11.7 percent in 2018 to 12.7 percent in 2019. The industry employed 5.71 million Filipinos in 2019, accounting for 13.5 percent of the total employment in the country.

- The hospitality and tourism industry has flourished steadily over the years. The sector encompasses a wide range of enterprises, including hotels, restaurants, travel agencies, and tour operators. However, its growth was severely affected by the COVID-19 pandemic. As inbound and domestic travel gain momentum in year 2023, tourism in the Philippines has seen a remarkable turnaround, breaching targets and continuing to generate employment to millions of Filipinos. South Korea was the biggest market for international tourists arriving in the Philippines in 2023, with about 1.44 million travellers.

- Tourists from the United States came in second, reaching roughly 900,000, followed by Japan with 285,655, China with 252,171, Australia with 238,487, Canada with 206,571, Taiwan with 186,140, United Kingdom with 141,516, Singapore with 140,633, and Malaysia with 92,383.

- Since 2023, the Department of Tourism (DOT) has been pushing for the construction of more rest areas and roads leading to tourist destinations across the country. The Philippines once again showcased the unrivalled charm of its beaches and underwater destinations to tourists from across the globe after bagging the World’s

- The Philippines tourism industry is estimated to stand at US$ 12.30 billion in 2024 and is forecasted to exceed a valuation of US$ 34.47 billion by 2034. Sales in the

Philippines tourism is primarily driven by promotional efforts by tourism boards, travel agencies, and online platforms. The Philippines travel industry is increasingly adopting sustainable practices. It aims to minimize environmental impact and promote responsible travel. Another evolving trend in the Philippines tourism industry is the increasing interest in medical and wellness tourism. The country is capitalizing on its natural resources to promote spa retreats and wellness-focused travel experiences. With the growth of remote work, more people are choosing to work while traveling. - The Philippines has an affordable cost of living and reliable internet connectivity. This trend makes the Philippines an attractive destination to remote workers.

Export and Trade:

The Philippines exports a variety of products such as electronics, garments, agricultural goods, and services. The country engages in international trade agreements and partnerships to promote economic growth and market access.

Innovation and Technology:

The Philippines is embracing digital transformation and innovation in sectors like information technology, e-commerce, fintech, and startup entrepreneurship. Tech hubs and incubators support the growth of the digital economy.

Sustainable Development: conservation, and eco-tourism.

Cultural Diversity:

The Philippines is committed to sustainable development goals, environmental conservation, and climate action. Initiatives focus on renewable energy, waste management, biodiversity The Philippines is a melting pot of cultures, languages, and traditions. Each region has unique customs, festivals, and practices that contribute to the country’s rich cultural tapestry and

Social Entrepreneurship:

Social enterprises in the Philippines address social and environmental issues through business solutions. Initiatives focus on livelihood programs, education, healthcare, environmental conservation, and community empowerment.

Youth Empowerment:

Filipino youth are actively engaged in social initiatives, advocacy, and entrepreneurship. Youth organizations, volunteer programs, and leadership development opportunities empower young people to create positive change in society.

Gender Equality and Women’s Empowerment:

The Philippines has made strides in promoting gender equality and empowering women in various sectors. Initiatives focus on women’s rights, education, economic opportunities, and political participation.

Cultural Festivals and Traditions:

The Philippines is renowned for its colourful and vibrant festivals that celebrate local culture, history, and traditions. Festivals like the Ati-Atihan, Sinulog, and Dinagyang showcase lively parades, music, dance, and culinary delights.

Art and Handicrafts and wood carving reflect the country’s craftsmanship and creativity. Filipino artists and artisans create a wide range of traditional and contemporary art forms, including paintings, sculptures, textiles, pottery, and jewelry. Handicrafts like basketry, weaving,

Traditional Healing Practices:

Traditional Filipino medicine incorporates indigenous healing methods, herbal remedies, and spiritual practices. Traditional healers, known as “albularyo” or “hilot,” provide holistic health treatments based on ancient knowledge and beliefs.

Wildlife and Biodiversity:

The Philippines is recognized for its rich biodiversity, with a vast array of endemic species of flora and fauna. Conservation efforts protect endangered species, marine habitats, and natural ecosystems to preserve the country’s unique biodiversity.

Cultural Experiences and Homestays:

Immersing in Filipino culture through homestays, cultural tours, and community-based tourism offers visitors a deeper understanding of local customs, traditions, and way of life. Interacting with locals and participating in cultural activities provide enriching experiences.

Indigenous Peoples and Heritage Preservation:

indigenous rights contribute to the country’s cultural richness and diversity.

A special thanks from TBA to Edelyn Ensomo of Exceed Executive Concierge for compiling such amazing detailed information for our business travellers.